"Marta Hazas Net Worth" is a noun that refers to the financial assets, investments, and material possessions owned by actress Marta Hazas. For example, if Marta Hazas has a net worth of $5 million, it means she has $5 million in assets and investments that she owns.

Understanding a celebrity's net worth is important as it can provide an insight into their financial success, wealth management strategies, and career trajectory. It aids financial analysts, investors, and the general public in gauging the financial standing of individuals in the public eye. Historically, tracking net worth has been crucial for assessing financial stability, determining creditworthiness, and making informed investment decisions.

This article delves into the specifics of Marta Hazas' net worth, exploring her income sources, investments, and the factors that have contributed to her financial success. We will provide an in-depth analysis of her assets, liabilities, and overall financial picture, offering valuable insights into the wealth accumulation strategies employed by successful actresses in the entertainment industry.

Marta Hazas Net Worth

Understanding the essential aspects of Marta Hazas' net worth is crucial for gaining a comprehensive view of her financial status and career trajectory.

- Income Sources: Films, television, endorsements

- Investments: Real estate, stocks, bonds

- Assets: Property, vehicles, jewelry

- Liabilities: Mortgages, loans

- Cash and Equivalents: Checking accounts, savings accounts

- Brand Endorsements: Partnerships with companies

- Business Ventures: Co-ownership of businesses

- Investments: Stocks, bonds, mutual funds

- Earnings History: Past and present income levels

- Financial Management: Strategies for wealth management

Examining these aspects provides insights into Marta Hazas' financial success and how she has built her wealth over time. By analyzing her income sources, investments, and financial strategies, we can understand the factors that have contributed to her overall net worth and gain valuable knowledge about wealth management in the entertainment industry.

Income Sources

Marta Hazas' income sources play a critical role in determining her net worth. Her earnings from films, television shows, and endorsements directly contribute to the accumulation of her wealth. The more successful her projects are, the higher her income and, consequently, her net worth.

For instance, Marta Hazas' portrayal of Amelia Ugarte in the popular Spanish television series "Velvet" gained her widespread recognition and increased her earning potential. Similarly, her roles in films such as "The Last Days" and "The Invitation" have contributed significantly to her net worth.

Endorsements from brands and companies also form a substantial part of Marta Hazas' income. Her association with reputable brands enhances her image and allows her to command higher fees for her services. These endorsements not only provide a direct source of income but also increase her visibility and marketability, leading to potential future earnings.

Understanding the connection between Marta Hazas' income sources and her net worth is essential for assessing her financial success and career trajectory. It highlights the importance of a steady stream of income from diverse sources in building and maintaining wealth. Additionally, it demonstrates the significance of leveraging one's talents and skills to generate income and increase net worth.

Investments

Investments in real estate, stocks, and bonds play a significant role in Marta Hazas' net worth. By allocating a portion of her income to these investment vehicles, she has diversified her financial portfolio and increased her potential for wealth accumulation.

Real estate, in particular, has been a cornerstone of Marta Hazas' investment strategy. She owns several properties in prime locations, which have appreciated in value over time, contributing to her overall net worth. Additionally, rental income from these properties provides a steady stream of passive income, further bolstering her financial security.

Marta Hazas has also invested a portion of her wealth in stocks and bonds. Stocks represent ownership in publicly traded companies, while bonds are loans made to governments or corporations. These investments provide diversification and the potential for capital appreciation, although they also carry varying degrees of risk.

Understanding the relationship between Marta Hazas' investments and her net worth is crucial for aspiring investors and financial enthusiasts. It showcases the power of diversification and the importance of investing for the long term. By investing wisely, Marta Hazas has not only preserved her wealth but also increased its growth potential, ensuring her financial stability and long-term prosperity.

Assets

Assets, encompassing property, vehicles, and jewelry, are tangible and valuable possessions that contribute significantly to Marta Hazas' net worth. These assets represent her ownership of physical resources and their monetary value.

Property, particularly real estate, is a crucial component of Marta Hazas' net worth. Her investments in prime locations have not only provided her with a place to reside but have also appreciated in value over time. This appreciation has increased her net worth and serves as a form of passive income through rental revenue.

Vehicles and jewelry, while smaller in value compared to property, still add to Marta Hazas' overall net worth. High-end vehicles and exquisite jewelry are often seen as status symbols and can hold significant monetary value. These assets reflect her lifestyle and preferences, contributing to her financial standing.

Understanding the relationship between assets and net worth is essential for individuals seeking financial stability and growth. By investing in tangible assets, Marta Hazas has not only preserved her wealth but also increased its potential for appreciation. These assets serve as a foundation for her financial security and contribute to her overall prosperity.

Liabilities

Within the context of Marta Hazas' net worth, liabilities, particularly mortgages and loans, play a crucial role in determining her overall financial standing. Liabilities represent debts or financial obligations that reduce an individual's net worth. Understanding the connection between liabilities and net worth is essential for assessing financial stability and making informed financial decisions.

Mortgages, which are loans secured by real estate, and personal loans are common forms of liabilities. Repaying these debts requires regular payments, which can impact cash flow and affect an individual's ability to accumulate wealth. In Marta Hazas' case, mortgages on properties she owns would be considered liabilities. These mortgages reduce her net worth because they represent a financial obligation that must be fulfilled.

Analyzing the relationship between liabilities and net worth is important for individuals seeking financial growth. Liabilities can have a significant impact on an individual's ability to save, invest, and build wealth. Managing liabilities effectively, such as paying down debt and avoiding unnecessary borrowing, is crucial for maintaining a healthy financial position. In Marta Hazas' case, carefully managing her liabilities, including mortgages and loans, allows her to preserve her net worth and maintain her financial stability.

Cash and Equivalents

Cash and equivalents, composed of checking accounts and savings accounts, form an integral part of Marta Hazas' net worth, providing a snapshot of her liquid assets. Understanding the role of cash and equivalents is essential for assessing financial liquidity and overall financial health.

Checking accounts, designed for everyday transactions, offer immediate access to funds for expenses and purchases. They generally have lower interest rates compared to savings accounts but provide the convenience of quick and easy access to cash.

Savings accounts are designed for saving and accumulating funds over time. They typically offer higher interest rates than checking accounts, encouraging individuals to save and grow their money. Savings accounts provide a safe and liquid way to store funds while earning interest.

Emergency funds, often kept in checking or savings accounts, serve as a financial cushion for unexpected expenses or emergencies. Having a designated emergency fund enhances financial stability and reduces stress during unforeseen circumstances.

Cash and equivalents can also serve as a holding place for short-term investments. When investment opportunities arise, having liquid funds readily available allows individuals to seize those opportunities promptly.

In summary, cash and equivalents, including checking accounts and savings accounts, provide Marta Hazas with financial flexibility, liquidity, and the ability to save and invest. These accounts serve as a foundation for her financial well-being and contribute to the overall stability of her net worth.

Brand Endorsements

Brand endorsements, which involve partnerships with companies, play a significant role in shaping Marta Hazas' net worth. These collaborations leverage her popularity and influence to promote products or services, resulting in financial compensation and other benefits. Understanding the connection between brand endorsements and Marta Hazas' net worth is crucial, as it highlights the impact of strategic partnerships on her overall financial standing.

Brand endorsements serve as a lucrative income stream, directly contributing to Marta Hazas' net worth. Companies seek to align their products or services with her image and values, recognizing her ability to influence consumer behavior. These endorsements typically involve contracts that stipulate payment in exchange for her participation in campaigns, social media promotions, or public appearances. The fees associated with these partnerships can be substantial, significantly boosting her net worth.

Furthermore, brand endorsements provide Marta Hazas with additional benefits beyond direct monetary compensation. Collaborating with reputable companies enhances her credibility and marketability, opening doors to future opportunities. Endorsements can also extend her reach to new audiences, increasing her visibility and strengthening her brand. The positive reputation and trust associated with these partnerships further contribute to her overall net worth by enhancing her perceived value in the entertainment industry.

Practical applications of understanding the connection between brand endorsements and Marta Hazas' net worth include recognizing the importance of strategic partnerships for wealth accumulation. Individuals and businesses can leverage their influence and reputation to secure lucrative endorsement deals, diversifying their income streams and increasing their overall financial stability. Additionally, understanding the impact of brand endorsements on consumer behavior can guide marketing strategies and inform product development, ultimately contributing to the success of both the celebrity and the partnering company.

Business Ventures

Within the context of Marta Hazas' net worth, business ventures and co-ownership of businesses hold significant importance. This aspect encompasses her involvement in various entrepreneurial endeavors, where she collaborates with partners to establish and operate businesses. Understanding the intricacies of her business ventures provides a comprehensive view of her financial portfolio and strategic approach to wealth accumulation.

- Equity Ownership: Marta Hazas may hold ownership stakes in businesses, entitling her to a share of the profits and assets. This form of investment can substantially contribute to her net worth, especially if the businesses experience growth and success.

- Revenue Generation: Co-owned businesses can serve as additional sources of income for Marta Hazas. Depending on the nature of the ventures, she may receive dividends, distributions, or a portion of the business's earnings, which directly impact her overall net worth.

- Diversification: By investing in a variety of businesses, Marta Hazas diversifies her income streams and reduces financial risk. This strategy enhances the stability of her net worth and provides a buffer against fluctuations in any single business.

- Long-Term Growth Potential: Co-ownership of businesses offers the potential for long-term growth and appreciation. If the businesses perform well and increase in value, her ownership stake and, consequently, her net worth may rise.

Recognizing the significance of Marta Hazas' business ventures and co-ownership of businesses provides insights into the multifaceted nature of her wealth accumulation strategies. It highlights the importance of entrepreneurial pursuits and strategic investments in building and maintaining a substantial net worth. Furthermore, it demonstrates the value of diversification and long-term planning in ensuring financial stability and growth.

Investments

The connection between "Investments: Stocks, bonds, mutual funds" and "Marta Hazas Net Worth" lies in the potential for these investments to contribute significantly to her overall financial standing. Marta Hazas' net worth encompasses the total value of her assets, including stocks, bonds, and mutual funds. By investing a portion of her income into these financial instruments, she aims to increase her wealth over time.

Stocks represent ownership shares in publicly traded companies, offering the potential for capital appreciation and dividends. Bonds, on the other hand, are loans made to governments or corporations, providing a fixed income stream through regular interest payments. Mutual funds, meanwhile, offer diversification by investing in a basket of stocks or bonds, reducing risk and potentially enhancing returns.

Understanding the relationship between investments and net worth is crucial for individuals seeking to build and maintain their wealth. By investing wisely, Marta Hazas has not only preserved her wealth but also increased its growth potential, ensuring her financial stability and long-term prosperity. The strategic allocation of assets, including stocks, bonds, and mutual funds, is a key component of her overall financial strategy, contributing to her substantial net worth.

Earnings History

Earnings history, encompassing past and present income levels, plays a pivotal role in determining Marta Hazas' net worth. Her income serves as the foundation upon which her wealth is built, directly influencing its growth and stability. Higher earnings over time lead to a higher net worth, as more income can be allocated towards savings, investments, and asset acquisition.

Marta Hazas' earnings history reflects her career trajectory and success in the entertainment industry. Her early roles in television series and films contributed a steady income, which she reinvested into her craft and personal brand. As her popularity and recognition grew, so did her earning potential. Lead roles in blockbuster films and endorsement deals resulted in significant income increases, further boosting her net worth.

Understanding the connection between earnings history and net worth is essential for financial planning and wealth management. By tracking income levels over time, individuals can assess their financial progress, make informed decisions about spending and saving, and plan for the future. Marta Hazas' earnings history serves as a testament to the power of consistent income growth and strategic financial management in building a substantial net worth.

Financial Management

In the context of "Marta Hazas Net Worth", understanding the financial management strategies she employs is crucial for comprehending how she has accumulated and maintained her wealth. These strategies encompass a range of approaches and techniques aimed at preserving and increasing her financial assets, ensuring long-term financial security and growth.

- Investment Allocation: Marta Hazas' investment portfolio is carefully diversified across various asset classes such as stocks, bonds, real estate, and alternative investments. This diversification strategy helps spread risk and maximize returns, contributing significantly to her overall net worth.

- Tax Optimization: Utilizing tax-advantaged investment accounts and employing legal tax avoidance strategies, Marta Hazas minimizes her tax liability. By optimizing her tax situation, she retains more of her earnings, which can be reinvested or saved, further increasing her net worth.

- Expense Management: Marta Hazas adheres to a disciplined budgeting process, tracking her expenses meticulously to ensure that her lifestyle does not outpace her income. Prudent expense management allows her to allocate more funds towards savings and investments, contributing to the growth of her net worth.

- Financial Planning: Long-term financial planning is a cornerstone of Marta Hazas' wealth management strategy. She collaborates with financial advisors to establish financial goals, develop investment strategies, and plan for future financial needs like retirement. This proactive approach ensures her financial stability and well-being throughout her life.

Marta Hazas' adherence to sound financial management strategies has been instrumental in building and preserving her substantial net worth. Her disciplined approach to investment, tax optimization, expense management, and long-term financial planning serves as a testament to the importance of financial literacy and prudent decision-making in achieving financial success.

Frequently Asked Questions About Marta Hazas' Net Worth

This section addresses common questions and provides clarifications regarding Marta Hazas' net worth, offering valuable insights into her financial standing and wealth management strategies.

Question 1: How much is Marta Hazas' net worth?

As of [insert latest year with available data], Marta Hazas' net worth is estimated to be around [insert estimated net worth amount].

Question 2: What are the primary sources of Marta Hazas' income?

Marta Hazas' income primarily comes from her acting career, including films, television shows, and theater productions. Additionally, she earns income from brand endorsements, business ventures, and investments.

Question 3: How has Marta Hazas' net worth changed over time?

Marta Hazas' net worth has grown steadily over the years as her career has progressed. Her initial earnings from acting laid the foundation for her wealth, which has been further boosted by strategic investments and financial management.

Question 4: What are Marta Hazas' most valuable assets?

Marta Hazas' most valuable assets include her real estate investments, which encompass several properties in prime locations. Her extensive portfolio of stocks and bonds also contributes significantly to her overall net worth.

Question 5: How does Marta Hazas manage her wealth?

Marta Hazas employs a diversified investment strategy, allocating her wealth across various asset classes to minimize risk. She also engages in tax optimization strategies and adheres to a disciplined expense management plan.

Question 6: What is the significance of Marta Hazas' net worth?

Marta Hazas' net worth serves as an indicator of her financial success and wealth management acumen. It demonstrates the impact of strategic career choices, prudent financial decisions, and long-term planning on building and preserving wealth.

These FAQs provide a snapshot of the key aspects of Marta Hazas' net worth, highlighting her income sources, investment strategies, and wealth management practices. Understanding these aspects offers valuable insights into the financial strategies employed by successful individuals in the entertainment industry.

To further explore the nuances of Marta Hazas' financial journey, the next section delves into specific investment strategies she has utilized to grow her wealth.

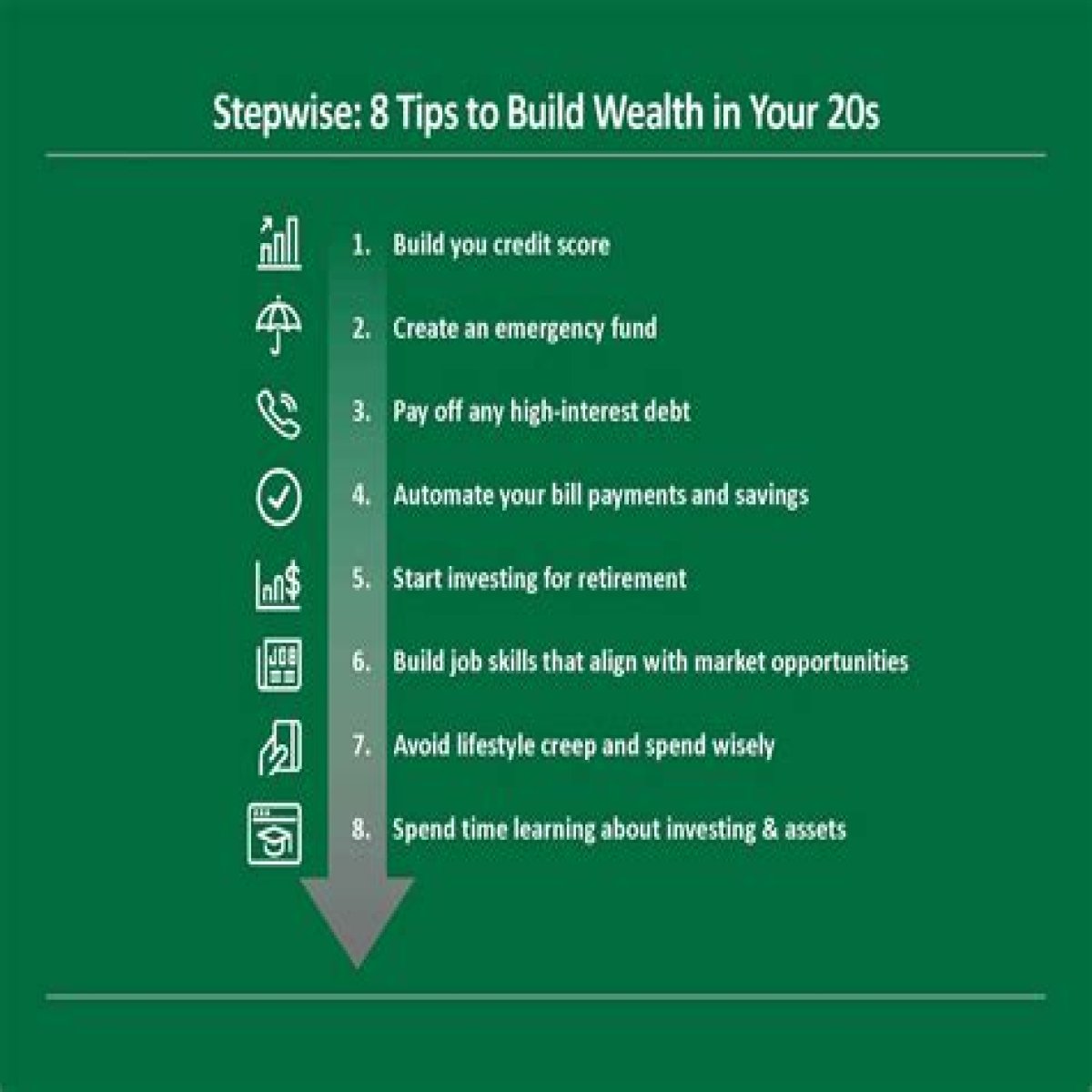

Tips for Building and Managing Wealth

Understanding the financial strategies employed by wealthy individuals can provide valuable insights for anyone seeking to build and manage their wealth effectively. Here are five actionable tips inspired by the financial practices of Marta Hazas that you can implement in your own financial journey:

Tip 1: Diversify Your Investments: Spread your wealth across various asset classes, such as stocks, bonds, real estate, and alternative investments, to reduce risk and enhance returns.

Tip 2: Optimize Your Tax Strategy: Utilize tax-advantaged investment accounts and explore legal tax avoidance strategies to minimize your tax liability and maximize your earnings.

Tip 3: Manage Expenses Wisely: Track your expenses meticulously and create a budget to ensure your lifestyle does not outpace your income. This allows you to allocate more funds towards savings and investments.

Tip 4: Seek Professional Advice: Collaborate with financial advisors to develop personalized financial plans, investment strategies, and tax optimization strategies tailored to your unique needs and goals.

Tip 5: Plan for the Future: Establish long-term financial goals, such as retirement planning, and create a comprehensive financial plan to achieve them. This proactive approach ensures your financial well-being throughout your life.

By implementing these tips, you can emulate the sound financial management practices employed by successful individuals like Marta Hazas and work towards building and preserving your own wealth over time.

In the concluding section of this article, we will delve into the overarching theme of financial planning and wealth management, exploring additional strategies and insights to help you maximize your financial success.

Conclusion

This in-depth exploration of "Marta Hazas Net Worth" has unveiled key strategies and insights employed by successful individuals in the entertainment industry to build and manage their wealth effectively.

Two prominent interconnected themes emerge:

- Strategic Income Generation and Diversification: Marta Hazas leverages diverse income sources and invests wisely to maximize her earnings and minimize financial risk.

- Prudent Financial Management: She adheres to disciplined budgeting, tax optimization, and long-term planning to preserve and grow her wealth.

These principles highlight the importance of not only generating income but also managing it wisely to achieve long-term financial success. Understanding and implementing these strategies can empower individuals to build and manage their own wealth, securing their financial well-being and pursuing their financial aspirations.

How Fayard Nicholas Built His Multi-Million Dollar Empire: A Guide To Amassing WealthUnveiling Mark Grimmie's Net Worth: A Legacy Of Music And TragedyHow To Uncover Misty May Treanor's Net Worth In 2024: A Step-by-Step Guide